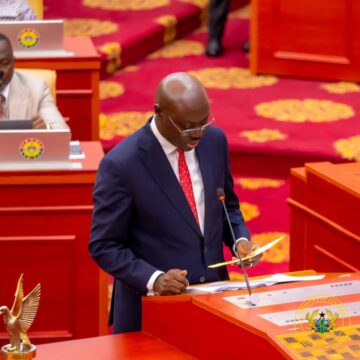

Parliament has approved the removal of the Electronic Transaction Levy (E-Levy) as part of the 2025 budget statement. This move follows the passage of the Electronic Transaction Levy (Repeal) Bill, 2025, on Wednesday, March 26. Finance Minister Dr. Cassiel Ato Forson had previously announced the government’s plan to abolish the E-Levy, along with the 10%...

FlashNews:

E-Levy Abolished: Parliament Gives Approval

Mahama Unveils 71 Nominees for District Chief Executive Roles

Bawumia donates GH¢200K, 1000 bags of Cement to Adum fire victims

Forestry Commission officer battles for life after attack by illegal miners in Offin

Fighting galamsey without involving chiefs a fruitless exercise – E/R House of Chiefs

E-Levy removal to take effect by end of March – Deputy Finance Minister

Removal of E-levy, Betting Tax poses risk to govt’s ability to achieve its revenue target – Deloitte

13-member committee set up to review L.I. 2180 for commercial use of ‘Okada’

‘Betting isn’t ideal, but it’s solace for many’ – Felix Kwakye Ofosu defends removal of winnings tax

Akufo-Addo’s Gov’t Squanders GH¢195 BILLION in Dubious Contracts!

Dr. Amoah demands investigation into National Cathedral Funds

Transforming Ghana: 24-Hour Economy and 4 Other Major Initiatives in 2025 Budget

Amin Adam Claims GOLDBOD is a Vehicle for ‘Looting’ Public Funds

Government Won’t Use Public Funds to Rescue Bank of Ghana- Finance Minister

Deputy Finance Minister Defends 3% Hike in Growth and Sustainability Levy

2025 Budget: Patrick Boamah Spells Out Minority’s expectations.

2025 Budget Pivotal to Ghana’s Economic Revival – Ato Forson

Education Minister urges Indonesia to establish Islamic Medical University in Northern Ghana

President Mahama Defends Scaled-Down Independence Day Celebration

Category: Business

E-Levy removal to take effect by end of March – Deputy Finance Minister

Deputy Finance Minister Thomas Ampem Nyarko has confirmed that the Electronic Levy (E-Levy) will be removed by the end of March 2025, pending approval of the 2025 budget and appropriation. Speaking on Channel One TV’s OXFAM Tax Dialogue, Nyarko stated that the removal will take effect once Parliament finalizes the budget process. He emphasized that...

Removal of E-levy, Betting Tax poses risk to govt’s ability to achieve its revenue target – Deloitte

Professional services firm, Deloitte has said that the theme running through this year’s budget statement is the need to strike a delicate balance between macroeconomic stability and economic growth. It indicated that a key component of the government’s approach to achieving the desired macroeconomic stability is revenue mobilisation. This notwithstanding, Deloitte said, the move by...

‘Betting isn’t ideal, but it’s solace for many’ – Felix Kwakye Ofosu defends removal of winnings tax

Government spokesperson Felix Kwakye Ofosu has defended the decision to remove taxes on betting winnings, citing the economic hardship and lack of employment opportunities faced by many young people. Speaking on JoyNews’ Roundtable, Kwakye Ofosu acknowledged that betting isn’t the most desirable activity, but it has become a means of survival for many. “We find...

Akufo-Addo’s Gov’t Squanders GH¢195 BILLION in Dubious Contracts!

Finance Minister Dr. Cassiel Ato Forson has revealed a staggering GH¢195 billion in contracts awarded by Ministries, Departments, and Agencies (MDAs) under the previous Akufo-Addo administration . Speaking in an interview with Channel One TV on Wednesday, March 12, just a day after presenting the 2025 Budget. Dr. Forson expressed alarm at the sheer scale...

Transforming Ghana: 24-Hour Economy and 4 Other Major Initiatives in 2025 Budget

Ghana’s 2025 Budget has unveiled five key interventions aimed at transforming the country’s economy, boosting job creation, and stabilizing national finances. These initiatives were announced by Finance Minister Dr. Cassiel Ato Forson on Tuesday, March 11, 2025. 1. 24-Hour Economy The 24-Hour Economy policy seeks to stimulate sustained economic growth by enabling businesses and institutions...

Amin Adam Claims GOLDBOD is a Vehicle for ‘Looting’ Public Funds

Former Finance Minister Dr. Mohammed Amin Adam has made some serious allegations against the current administration, accusing them of setting up the Ghana Gold Board (GOLDBOD) as a way to misappropriate public funds. Specifically, he’s taking issue with the allocation of GH₵270 million to GOLDBOD, which he believes is not only unjustified but also a...

Government Won’t Use Public Funds to Rescue Bank of Ghana- Finance Minister

Finance Minister Dr. Cassiel Ato Forson has made it clear that the government won’t be using taxpayer funds to bail out the Bank of Ghana (BoG) to the tune of ¢53 billion. This decision comes after the central bank’s request for a bailout due to its negative equity challenge under the previous Ernest Addison-led administration....

Deputy Finance Minister Defends 3% Hike in Growth and Sustainability Levy

Deputy Finance Minister Thomas Ampem Nyarko has defended the government’s proposal to increase the Growth and Sustainability Levy on mining companies from 1% to 3% of their gross production. This move aims to boost national revenue generation, particularly when global commodity prices are favorable. According to Ampem Nyarko, the modest increment is necessary to ensure...

2025 Budget: Patrick Boamah Spells Out Minority’s expectations.

Lawyer Patrick Boamah, Member of Parliament for Okaikwei Central, has outlined the minority’s expectations ahead of the 2025 Budget presentation by Finance Minister, Dr. Ato Forson, scheduled for Tuesday, March 11, 2025. The law maker outline the expectations of the minority where he stated that (the minority) will be expecting a clear cut policy and...